Berita baik dari kelanjutan penurunan ini adalah segera terciptanya kondisi oversold. Sehingga pada akhirnya akan memancing aksi beli dimana akan menggerakkan indeks untuk bergerak naik.

Sehubungan dengan kondisi candlestick IHSG terakhir yang membentuk engulfing bear , berikut saya kutip penjelasan dari expert advisor - Metastock :

'An engulfing bearish line occurred (where a black candle's real body completely contains the previous white candle's real body). The engulfing bearish pattern is bearish during an uptrend. It then signifies that the momentum may be shifting from the bulls to the bears.

If the engulfing bearish pattern occurs during a downtrend (which appears to be the case with IHSG), it may be a last engulfing bottom which indicates a bullish reversal. The test to see if this is the case is if the next candle closes above the bottom the current (black) candle's real body.'

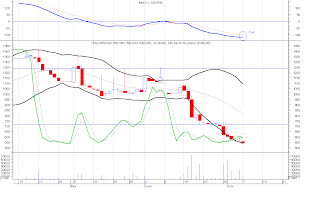

BUMI indicators:

- Stochastic oscillator : Fair

- Williams%R , Stochastic slow , DMS : Neutral

- ROC , RSI : Less Favourable

- MACD , AD Line , Diviation rate : Unfavourable

Target Price terdekat 7.650

YPAS masih menunggu perbaikan dari 4 indikatornya : stochastic oscillator , DMS , AD Line & Diviation rate. Selebihnya OKE. [stochastic slow , RSI , williams%R , MACD &ROC]. Memberikan trading range 20-30 poin.

Indikator SOBI terlihat mulai membaik.

SOBI indicators:

- Stochastic oscillator : Favourable

- MACD , AD Line , Stochastic slow , Stochastic slow : Fair

- Diviation rate , ROC , RSI , Williams%R , DMS : Neutral

Target Price terdekat 1.430

Transaksi hari ini:

- Beli 3 lot YPAS di harga : 560 , 550 & 540 , average = 576

- Beli 2 lot FREN di harga : 112 & 111

- Beli 6 lot FREN di harga 110 , average = 112

- Jual BNII , net profit Rp. 2.985,- (beli 465 [02.06.08] , jual 475 [07.07.08]

Ineffective Cost sebesar Rp. 16.903,-

Total fee hari ini Rp. 20.000,-

No comments:

Post a Comment